Providing information about prior paychecks issued to employees before the beginning of your QuickBooks Payroll subscription is an essential step to ensure that your W-2 forms are accurate come year-end. Note that the system will require you to input year-to-date (YTD) payroll details and tax payments made for each employee later in the setup. Newly established businesses that have yet to run their first payroll can select “No” and then click “Next.” Step 1: Navigate to PayrollĪfter having logged in to your QuickBooks account, you’ll want to navigate to the “Payroll” tab to get started. The same goes for QuickBooks-its setup wizard guides you through the whole process. Most online payroll services offer an intuitive interface that makes payroll setup easy.

If you are converting to QuickBooks Payroll in the middle of a calendar year, you should enter the total sick and vacation hours an employee had from your previous system. PTO policy and balance: If you offer vacation and sick pay, you need to know the total number of PTO hours you’re allocating to each employee for the year.Direct deposit authorization form: If you pay employees via direct deposit instead of paper checks, you must have them complete a direct deposit authorization form.

Payroll history: If you already paid employees within the current calendar year, you should have your prior payroll data on hand to ensure accurate tax calculations.Form W-4: Upon hiring new employees, you need to have them complete and sign a W-4 form so you can enter their withholding information and other pertinent details that you need to correctly calculate payroll tax deductions.Paycheck deductions: You should have a list of your employees’ contributions to health insurance, retirement plans, and garnishments.Pay rate and schedule: You can set up multiple pay schedules in QuickBooks, if needed.Employee information and hire date: You need basic information about your staff members, such as their legal names, birth dates, and hire dates.

Does clicktime integrate with intuit online payroll how to#

How to Manage Credit Card Sales With a Third-party Credit Card Processor How to Manage Credit Card Sales With QuickBooks Payments How to Reconcile Business Credit Card Accounts How to Manage Downloaded Business Credit Card Transactions How to Enter Business Credit Card Transactions Manually

Part 5: Managing Business Credit Card Transactions How to Handle Bounced Checks From Customers How to Transfer Funds Between Bank Accounts How to Manage Downloaded Banking Transactions How to Enter Banking Transactions Manually How to Set Up the Products and Services List

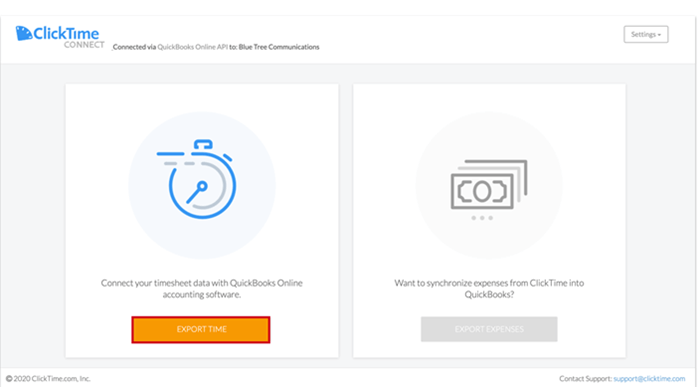

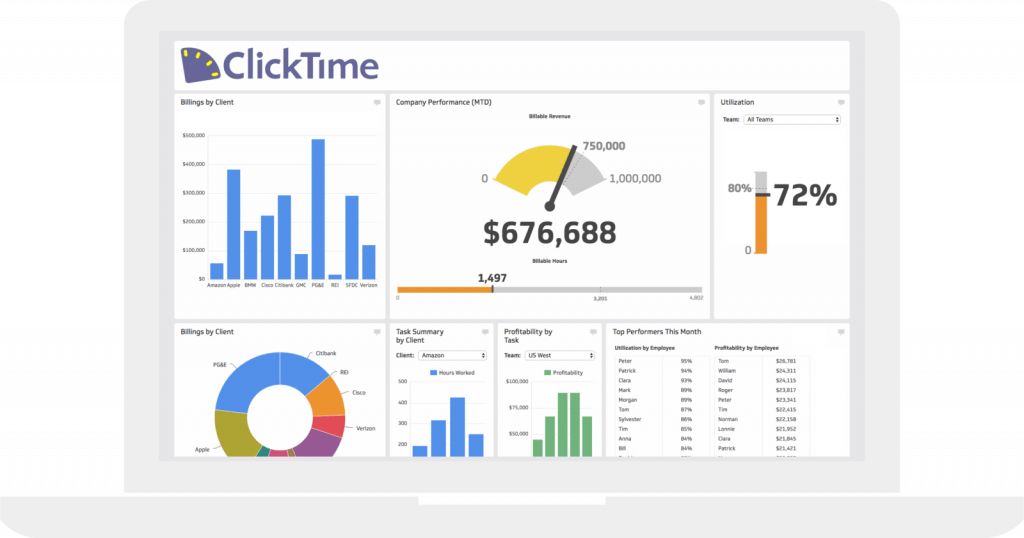

How to Set Up Invoices, Sales Receipts & Estimates Find out which experience you have and how to switch between the two.How to Customize Invoices, Sales Receipts & Estimates Note: This option isn't available yet for the new estimate and invoice experience. QuickBooks Time integrates with a variety of payroll and accounting software, allowing you to quickly and easily export hours worked for payroll, invoicing, job costing, and more.

0 kommentar(er)

0 kommentar(er)